First half Fiscal 2023 Results up strongly

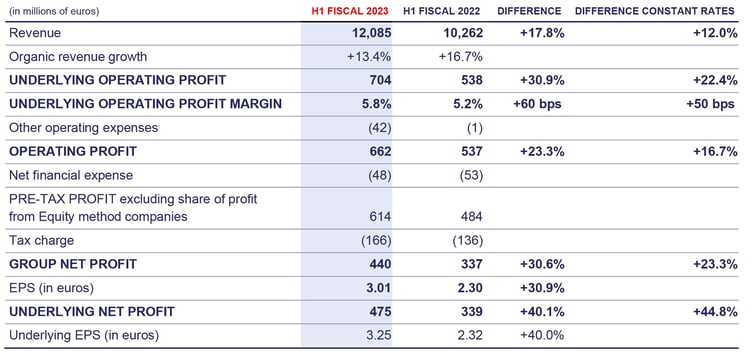

- First half Fiscal 2023 consolidated revenues were at 12.1 billion euros, up +17.8% year-on-year including a net contribution from acquisitions and disposals of -1.3% and a positive currency impact of +5.7%. Excluding these elements, organic revenue growth was +13.4%.

- On-site Services organic revenue growth was +12.9% for the period, benefiting from the ongoing post-Covid ramp-up particularly in Corporate Services, Sports & Leisure and Universities, as well as above 5% pricing effect. Net new development started to come through in the second quarter, contributing +0.5% to the growth in the First half. Food services recovered strongly up +20% organically. FM services were up +6% excluding the impact of the end of the Testing Centers contract in the UK. Food services represented 65% of total On-site Services revenues during the period, increasing from 59% in Fiscal 2022.

- First half Fiscal 2023 net new development was positive:

- Client retention was 97.8% with no unanticipated contract losses.

- New sales development was 3.6%, reaching a record more than 0.8 billion euros including cross-selling.

- First half Fiscal 2023 Benefits & Rewards Services revenue organic growth was +24.2%. Operating revenues were up +16.1% organically due to portfolio growth, positive net new development and an increase in face values. Financial revenues more than doubled due to the increase in interest rates in all geographies.

- Underlying operating profit was 704 million euros, up +30.9%, and +22.5% excluding currency effects. The Underlying operating margin was up +60 bps at 5.8%.

- Other operating expenses (net) amounted to 42 million euros against 1 million euros in First half 2022 last year benefited from significant positive one-offs.

- Operating profit was up strongly at 662 million euros compared to 537 million euros in the previous year.

- Net financial expense was 48 million euros against 53 million euros in the previous year. The reduction is principally due to higher interest rates on cash deposits.

- Effective tax rate was 27.1% against 28.3% in the previous year.

- Group net income was up +30.6% to 440 million euros. Underlying net profit adjusted for Other Operating income and expenses net of tax amounted to 475 million euros, compared to 339 million euros in the previous year, up +40.1%.

- Free cash outflow was 46 million euros against the cash outflow of 75 million euros in First half Fiscal 2022. Net capex was 234 million euros, compared to 159 million euros in the previous year. Gross capex was 317 million euros, or 2.6% of revenues.

- Net debt has reduced to 1.9 billion euros from 2.0 billion euros at the end of First half Fiscal 2022. As a result, gearing1 is reduced to 46% from 56% and the net debt ratio1 remains at the bottom end of the range at 1.3x compared to 1.8x at the end of First half Fiscal 2022.

- Once again, our Corporate Responsibility achievements have been recognized:

- Sodexo ranked 12th in the annual ranking published by Equileap, world leader in data and information on gender equality. Sodexo is equal 1st on the French podium.

- Sodexo received a special mention for “Workforce action” category at the WDI Workforce Transparency Awards.

- For the second consecutive year, Sodexo is on the CDP Supplier Engagement Leaderboard. The Group is among the top 8% companies taking action to measure and reduce environmental risks within its supply chain.

- Sodexo ranks in the top 10% companies in the "Restaurants & Leisure Facilities" sector for the excellence of its performance in terms of sustainable development in the S&P Global Sustainability Yearbook.

Plan to create two leading pure players in growth markets by splitting Sodexo On-site Services and Benefits & Rewards Services

The Sodexo Board of Directors has unanimously approved the project to separate the two business units of Sodexo by spinning-off and listing BRS through the distribution of BRS shares to Sodexo shareholders.

Bellon SA supports the plan and intends to continue playing a long-term controlling shareholder role in both businesses.

The contemplated transaction is expected to take place during 2024 following the completion of several customary steps, including consultation of the employee representative bodies, and remains subject to market conditions.

The Group confirms, and is more committed than ever to deliver, its mid-term guidance via the two separate entities.

Detailed transaction terms will be presented at a later stage and submitted to the approval of Sodexo’s shareholders at an extraordinary shareholders’ meeting. Sodexo’s bondholders and other lenders will be consulted on the proposed transaction in due course.

Strong strategic Rationale

By separating the two businesses, Sodexo intends to accelerate value creation for all its stakeholders:

- As two pure players dedicated to their respective markets and clients, one in Food and Facilities Management services and the other in employee benefits and engagement, each would be strategically more focused;

- Empowered and dedicated governance would drive enhanced business and financial performance;

- Conducting each business independently would help create a focused workforce and optimize employer attractiveness and people retention through dedicated compensation mechanisms;

- Both companies would be established with the adequate capital structures providing them with the full financial flexibility to execute their growth strategies, including specific M&A.

At separation, OSS and BRS would have capital structures consistent with a strong Investment Grade rating;

- Already operating vastly as an independent company, the spin-off and listing of BRS is not expected to generate any material adverse effects and would result in one-off costs customary for a transaction of this nature;

- The two differentiated investment profiles, with their respective business drivers, KPIs and stock market benchmarks would ensure that they attract the best suited investors.

Outlook

First half Fiscal 2023 was better than expected. As a result, Fiscal 2023 guidance for the Group and Benefits & Rewards Services has been revised up slightly.

Group Fiscal 2023 guidance upgraded on organic growth:

- Fiscal 2023 Organic revenue growth now expected close to +11%, driven by higher-than-expected growth in H1 and price increases to remain above 5% in H2

- Fiscal 2023 Underlying operating profit margin confirmed to be close to 5.5%, at constant rates

Benefits & Rewards Services Fiscal 2023 guidance upgraded on both organic growth and Underlying operating profit margin:

- Fiscal 2023 Organic revenue growth expected close to +20%

- Fiscal 2023 Underlying operating profit margin expected close to 32%, at constant rates

Group and Benefits & Rewards Services Fiscal 2024 and 2025 guidance reiterated:

- Group: +6 to +8% organic revenue growth and an Underlying operating profit margin above 6% at constant rates in FY2025

- Benefits & Rewards Services: low double-digit organic revenue growth and an Underlying operating profit well above 30% at constant rates in FY2025

Conference call

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its First half Fiscal 2023 results.

Those who wish to connect:

- from the UK / International, please dial: +44 (0) 121 281 8004

- from France, please dial: +33 (0) 1 70 91 87 04

- from the USA, please dial: +1 718 705 8796

Access Code: 07 26 14

A live audio webcast is also available on www.sodexo.com.

To read the full version of the press release, please download the PDF:

Watch the webcast

1 See Alternative Performance Measures definitions