Sodexo confirms First Half Fiscal 2017-2018 Results

At its meeting of April 10, 2018, chaired by Sophie Bellon, the Board of Directors approved the consolidated financial statements for the First Half Fiscal 2017-2018 and Denis Machuel, Chief Executive Officer, presented the performance for First Half Fiscal 2017-2018, which ended February 28, 2018.

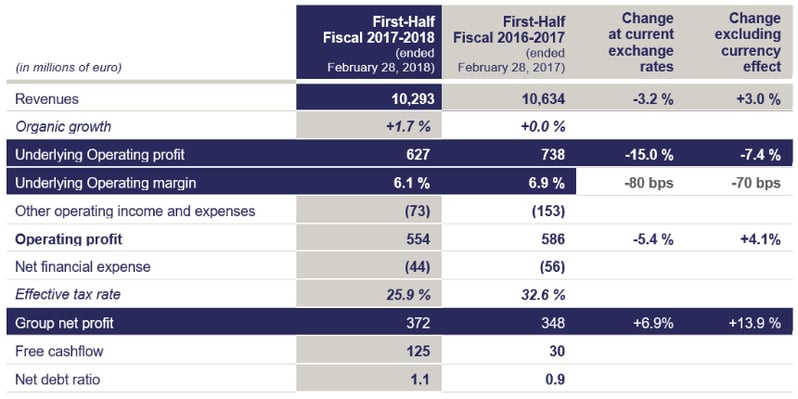

Financial performance for First Half Fiscal 2017-2018

"Sodexo’s fundamentals remain solid, but these results clearly identify areas where we must improve."

"We are acting decisively both to recover performance in the short term and drive growth in the longer term. We are highly focused on delivering efficiency and productivity improvements. At the same time, we are strengthening our performance-based and client-focused culture and reinvigorating our client portfolio. While pursuing our global multiservice contracts strategy, we must reinforce our focus on winning local contracts, mid-sized contracts, and food services contracts. We will reinforce our basics and take a disciplined approach to investing in our capabilities to ensure that we are best placed to take advantage of the multiple growth opportunities that are available to us, thanks to our Quality of Life positioning."

Highlights of the period

- First Half Fiscal 2018 Revenues of 10.3 billion euro were down -3.2% on the previous period, including a negative currency impact of -6.2%. Net acquisitions contributed +1.3%, with Centerplate consolidated for the first time as of January. Organic growth in the first half was +1.7%, or +1.9% excluding the 53rd week impact in North America. Outside North America, on-site organic growth was +4.4%.

- Organic growth of On-Site Services was +1.6%:

- In Business & Administrations, organic growth was +4.5% with a solid performance in all regions. In particular, there was a sharp increase in airport lounge business and a modest recovery in France. The Energy & Resources segment remained buoyant thanks to the contribution of contract ramp-ups and in spite of continuing challenges in the North Sea.

- The Health Care & Seniors segment was stable at -0.1%. Activity in North America remained weak due to a low development rate and a lack of growth at existing sites, even though client retention held up. In Europe, revenues were stable. Contract wins in the United Kingdom broadly compensated for contract losses elsewhere in Europe. In Asia and Brazil, robust development is continuing as well as same store sales across a number of sites.

- In Education, organic growth declined by -2.7%. In North America, the segment felt the impact of one less day in the half year and low client retention in Universities in the previous fiscal year, while growth at existing sites remained solid for Schools and Universities. Europe benefited from two additional days in Italy and France, while in Asia, the development was strong.

- In First Half Fiscal 2017-2018, organic growth in the Benefits & Rewards Services segment was +2.9%. In Europe, Asia and the United States, growth of +7.1% was driven by Central Europe, as well as a solid performance by the Incentive & Recognition segment in the United Kingdom. In Latin America, organic growth was down by -2.0%, impacted by the continued weakness in Brazil.

- At constant exchange rates, underlying operating profit decreased by -7.4% and the margin decreased by 70 basis points, spread evenly across three trends:

- Approximately one third of the margin decline was a result of expected factors such as lower interest rates in Brazil and the deconsolidation of certain activities and in particular Vivabox which is seasonally significant in the first half.

- A shortfall in Education and Health Care in North America due to delays in the execution of planned measures to increase efficiencies.

- A further shortfall resulted from the slower than expected ramp-up of profitability in a small number of significant contracts.

- Net profit was up by +6.9%, or +13.9% excluding currency effects, at 372 million euro, benefiting from lower exceptional charges than the previous year and a significant reduction in the tax charge.

- Underlying net profit was 397 million euro, down by -13.4% or -7.6% excluding currency effects. Overall this was in line with the trend in underlying operating profit.

- The Group continues to generate substantial free cash flow and the balance sheet remains strong with a net debt ratio of 1.1x.

- Changes in the Executive Committee:

- Denis Machuel succeeded Michel Landel as Chief Executive Officer at the end of the General Shareholders’ Meeting of January 23, 2018.

- Satya-Christophe Menard was appointed Chief Executive Officer of Schools and Universities worldwide on April 1, 2018.

- Sean Haley was appointed Chief Executive Officer of Service Operations worldwide on April 1, 2018.

- Sodexo’s Corporate Responsibility commitments led to the Group being ranked number-one in its sector in RobecoSAM’s “Sustainability Yearbook 2018” for the 11th consecutive year. Sodexo has also been named Supplier Engagement Leader by CDP (Carbon Disclosure Project) for its strategy to reduce carbon emissions throughout its supply chain.

- Confident in the Group’s future prospects and given the strength of the balance sheet, the Board approved the implementation of a share buyback program amounting to 300 million euro.

Outlook

For Fiscal 2018, the Group now expects to deliver organic revenue growth of between +1% and +1.5%, excluding the 53rd week impact, and an underlying profit margin of around 5.7%.

This revised guidance for Fiscal 2018 reflects the soft revenue growth and margin decline in the first half, and the compounded effect of delayed efficiency ramp-ups on the second half. Revenue growth in the second half will be impacted by a relatively low level of recent new contract wins; continued weakness in North America, particularly in Health Care and Seniors; a negative calendar effect in Education in the third quarter; the impact of contract losses in the UK; and the end of significant ramp-ups in Energy & Resources. The weak revenue growth in the second half, combined with the impact of the delayed efficiency ramp-ups and a further deterioration expected in North America Health Care, has led to our revised margin guidance.

As previously announced in our trading update on 29 March, immediate action plans have been put in place to address these issues, particularly in North America but also selectively across the rest of the Group, to improve our operational and financial performance. In the immediate term we are actively implementing a series of efficiency initiatives which are based on the following areas:

- Improving food management, particularly in North America, through a combination of SKU rationalization, greater discipline in supplier and product compliance and accelerating synergies from acquisitions.

- Enhancing labor productivity through more efficient demand-based scheduling processes and more disciplined approach to managing overtime and temporary labor.

- Optimizing SG&A with an immediate reduction in discretionary spend and adopting a longer-term approach to right-sizing the organization and consolidating back offices.

- Addressing underperforming contracts with detailed action plans, more proactive client renegotiations and close monitoring by a dedicated member of the Executive Committee for each contract.

We are actively addressing the execution issues in North America and are revitalizing the management team there, bringing some of our most experienced senior people from within the Group as well as external hires who will bring new ideas and new ways of doing things.

These action plans will deliver benefits in Fiscal 2018 and they will also support further margin improvement over time. These measures are embedded in a long-term strategic agenda which will refocus the Group on delivering improved Operational Excellence.

The guidance for Fiscal 2018 has been revised to reflect the challenges Sodexo is currently facing. At the same time, the Board of Directors and Executive Committee remain highly confident in the attractive long-term growth opportunities for Sodexo. The Group will provide an update on its short-term action plans and long-term strategy at its Capital Markets Day on September 6, 2018.

To read the full version of the press release, please download the PDF

- Press release (PDF)

- Presentation (PDF)

Conference Call

Sodexo will hold a conference call (in English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time), to comment on the results of First Half Fiscal 2018. Those who wish to connect from the USA may dial +1 323 794 2093, from the UK or other countries outside France may dial +44 (0) 330 336 9411 or from France +01 76 77 22 57, followed by the passcode 842 62 54.